Double-Digit Returns

backed by Real Estate

Secure, asset-backed opportunities designed to outperform

traditional markets while preserving your capital.

We are not a fund — each investment is backed by a first-lien mortgage.

Double-Digit Returns

Fixed Returns. Passive Income

Safe & Secure

Honesty and transparency

Backed by Real Estate

Passively without being a landlord

WHO WE ARE

RDestiny REI

RDestiny REI is a private real estate finance company connecting investors to first-lien note opportunities across the Midwest. Each loan is secured by property with a recorded mortgage and promissory note, delivering fixed, collateral-backed returns — without tenants, repairs, or volatility.

Double-Digit Returns

Passive Positive Cashflow

No Tenants, No Toilets, No Trash

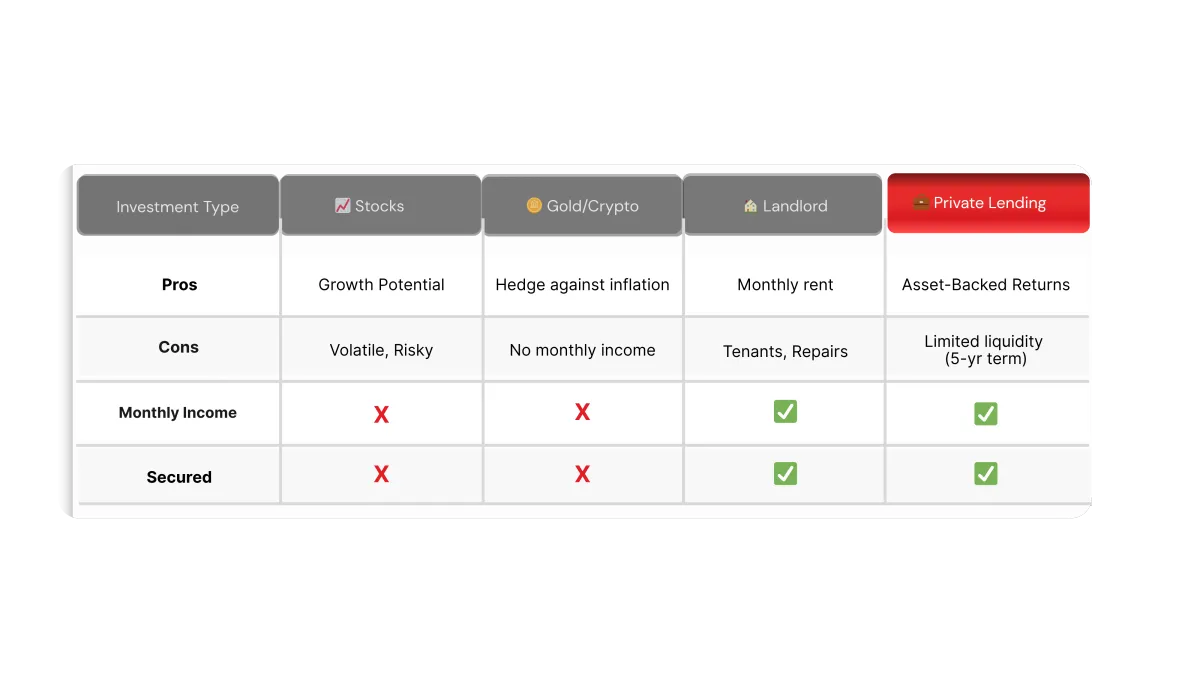

Why Asset-Backed Notes Win

Compare Your Options

Diversify your portfolio with predictable, asset-backed performance

Built for Stability — Not Speculation

Unlike gold or crypto, which rely on appreciation alone, our model delivers monthly income — not theoretical gains. And unlike being a landlord, investors enjoy predictable, fixed returns without the headaches of tenants, repairs, or vacancies.

In short:

✅ You earn consistent income

✅ Asset secured by real estate

✅ Diversification beyond Wall Street

For investors seeking steady returns, collateral-backed security, and freedom from market turbulence, this is a proven path to long-term financial stability and diversification.

Reimagining the way people

invest in Real Estate

Unlike stocks, bonds, or traditional retirement accounts, our model creates double-digit returns secured by first-lien real estate notes. With conservative loan-to-value targets, SDIRA-friendly structures, and professional asset servicing, investors enjoy fixed, predictable outcomes

Midwest Market Focus

Why the Midwest?

Predictable Returns in Stable, Working-Class Markets

The Midwest offers one of the strongest environments for our financing model — stable home prices, strong rental demand, and a workforce-driven economy.

Cities like Toledo, Dayton, St. Louis, and Peoria share affordable entry points ($25K–$60K), high rent-to-price ratios, and predictable cash flow — ideal conditions for consistent note performance.

This balance of low acquisition cost and solid end-buyer affordability creates a predictable, cash-flowing market with room for sustainable growth.

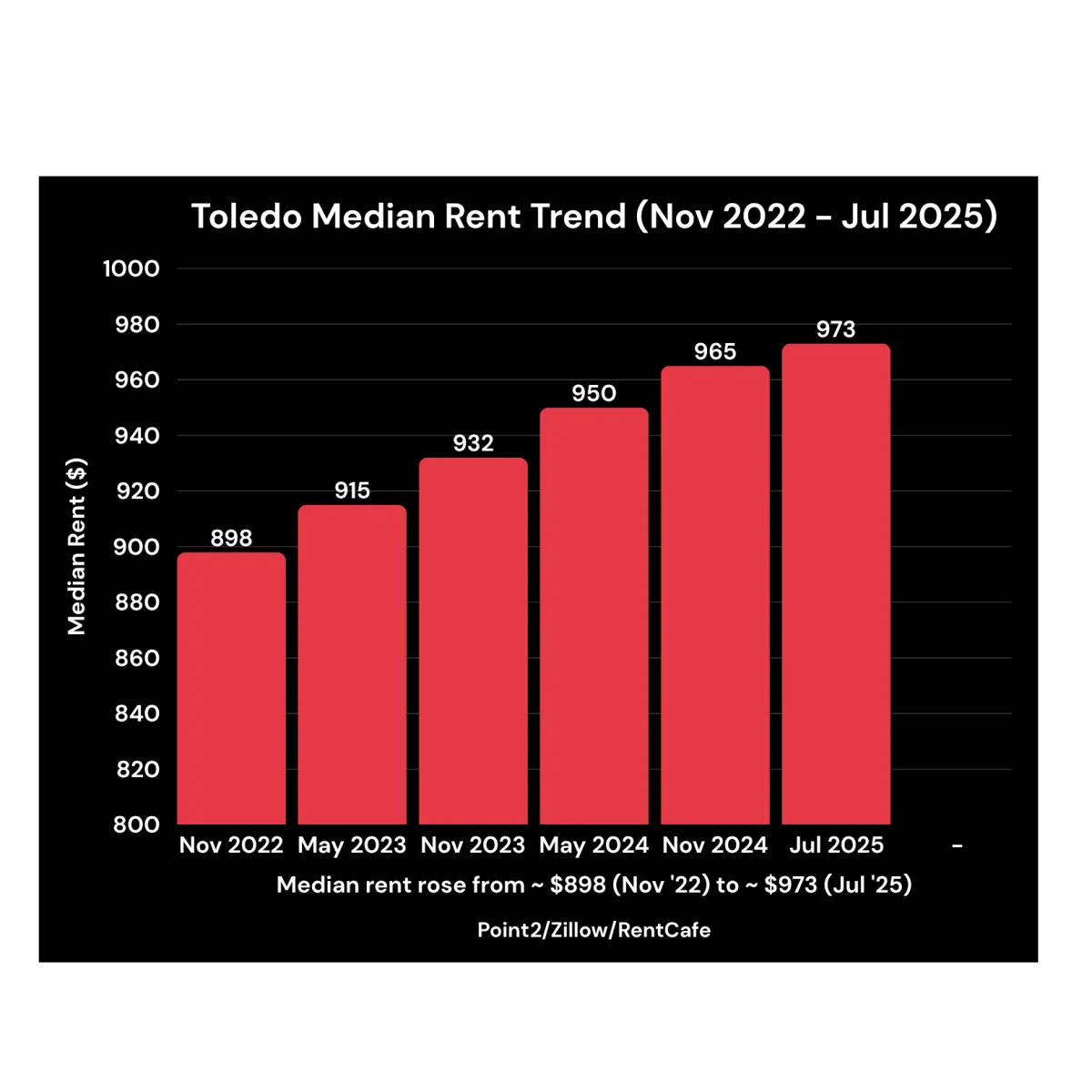

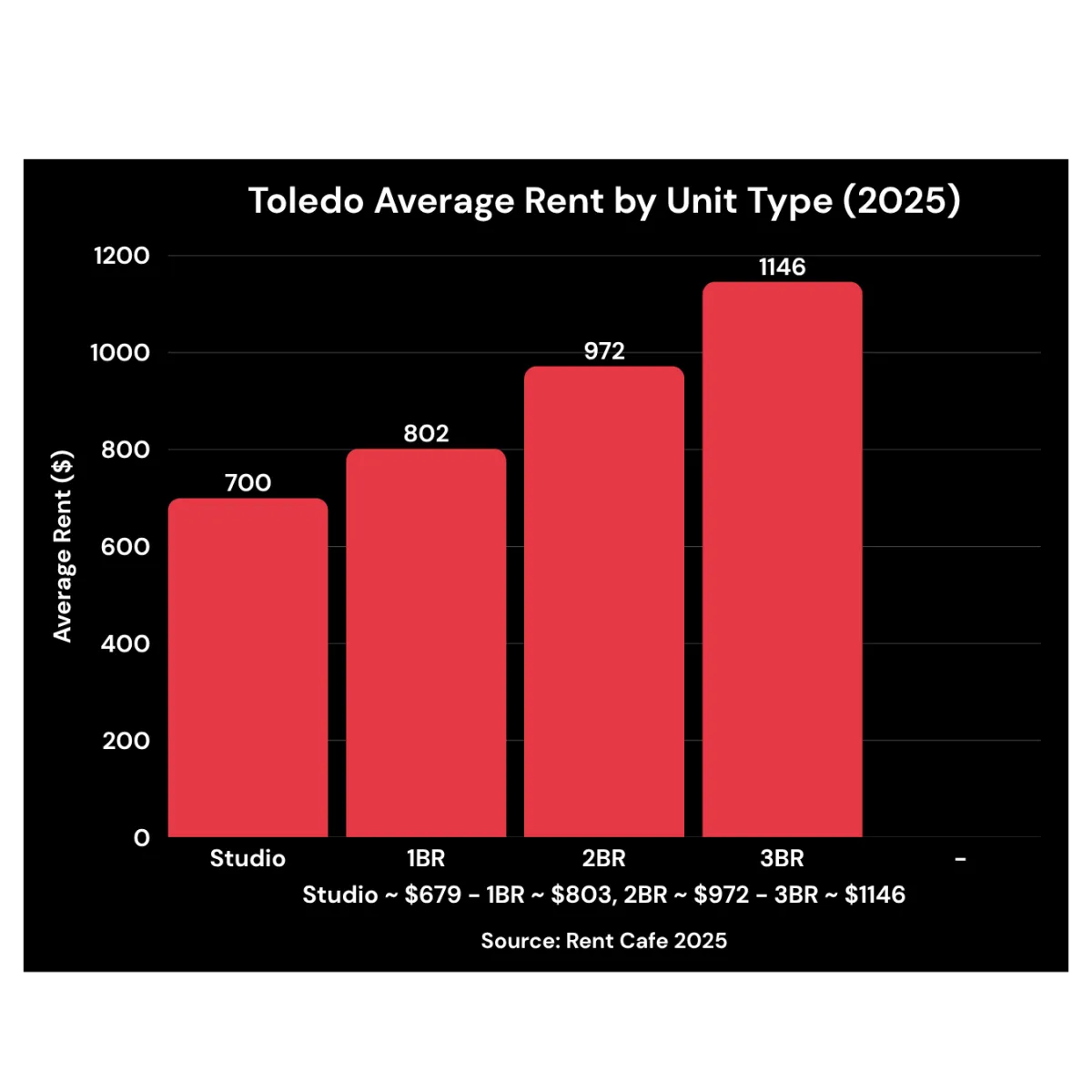

Example Market: Toledo, OH

Affordable yet resilient—steady rent growth, low vacancy, and a younger renter base support predictable occupancy.

Median rent rose from ~$898 (Nov 2022) to ~$973 (Jul 2025). Sources: Point2 / Zillow / RentCafe

Figures approximate based on 2024–2025 summaries from Point2, RentCafe, Zillow, and Census (ACS). Not investment advice; all investments carry risk.

Studio ~$679 · 1BR ~$803 · 2BR ~$972 · 3BR ~$1,146. Source: RentCafe 2025.

Avg Rent

~$973–$975 / mo (Jul 2025)

Vacancy

~4.9%

(tight market)

Median age ~35;

HH income

~$46–47K

Ready to Explore First-Lien Real Estate Notes?

Disclosure: This information is for educational purposes only and is not legal, financial, or investment advice. RDestiny Real Estate Investing LLC is not your advisor unless agreed to in writing.

Please consult your own professional advisors before making financial decisions. Information shared is believed reliable but not guaranteed and may change. We may have referral relationships that provide compensation.

Copyright 2025. RDestiny REI. All Rights Reserved.

Facebook

Instagram

LinkedIn

Youtube